Welcome to summer!

It’s really rare that acts of explosive deconstruction are the highlight of my month, but June was a special month. It welcomed summer and saw us bid farewell to a Quad Cities icon, the I-74 Twin Bridges.

Photo credit: Our friend, Roberta Osmers, Illuminated Scene Photography

The first span opened in November of 1935, one lane in each direction, providing an unprecedented opportunity to cross the Mississippi River in comfort and style. Businesses boomed, the cities grew, and the solution was to create a second span, just a hundred feet downriver of the first, using the same set of blueprints. That span, which allowed two lanes into Illinois, opened in 1959. By 2012, the Secretary of Transportation declared the old bridge “one of the worst bridges I’ve ever seen.” (We never liked him anyway.)

Its successor, begun in 2017, so completely dwarfs the old bridges that … well, here …

John Adams had a fairly poor start to his summer. He was sort of zero-for-two on celebrations.

Reflecting on the recently passed Declaration of Independence, Adams prophesied:

The Second Day of July 1776 will be the most memorable Epocha, in the History of America. I am apt to believe that it will be celebrated, by succeeding Generations, as the great anniversary Festival… It ought to be solemnized with Pomp and Parade with Shews, Games, Sports, Guns, Bells, Bonfires and Illuminations from one End of this continent to the other from this Time forward forever more. (Letter to Abigail Adams, 7/3/1776)

So close, John. So very close. The Continental Congress did vote to declare American independence on July 2, 1776, which is what Adams exulted in. So what’s up with the July 4th date? The most crass and contemporary explanation is that’s the date on the press release announcing the decision. After voting for independence, the delegates had a small committee provide a final, formal draft of what they’d done and why. The group reviewed it on July 4 and authorized having a printer run 200 copies over for John Hancock’s signature.

In short: July 4, 1776, is the date of the most important press release in American history. Grab some skyrockets!

Adams also slightly whiffed on his preference for the Great Seal of the United States. That’s the thing with the bald eagle, the “e pluribus unum” banner, thirteen arrows, and all. There was a vigorous debate, recounted lately in the Wall Street Journal about the appropriate creature to symbolize the new nation of its role in the universe. Some favored the white-tailed deer, elusive and resilient. Some (ahem, Benjamin Franklin) preferred the turkey, fearless and a native. Many were taken by the beaver, industrious and willing to push others to work. The eagle, a native bird symbolically holding the olive branch of peace with one set of talons and the arrows of war with the other, prevailed.

Adams also slightly whiffed on his preference for the Great Seal of the United States. That’s the thing with the bald eagle, the “e pluribus unum” banner, thirteen arrows, and all. There was a vigorous debate, recounted lately in the Wall Street Journal about the appropriate creature to symbolize the new nation of its role in the universe. Some favored the white-tailed deer, elusive and resilient. Some (ahem, Benjamin Franklin) preferred the turkey, fearless and a native. Many were taken by the beaver, industrious and willing to push others to work. The eagle, a native bird symbolically holding the olive branch of peace with one set of talons and the arrows of war with the other, prevailed.

Then a few, like Adams, appear to have slept through their “Introduction to Visual Design” lectures and came up with an intricate allegorical soup:

Hercules, as engraved by Gribelein, in some editions of Lord Shaftebury’s works. The hero resting on his club. Virtue pointing to the rugged mountains on one hand, and persuading him to ascend.

Lin-Manuel Miranda wasn’t much more charitable to Adams, in Hamilton. On the upside, he was the hero of 1776, the Hamilton of its day, which followed Adams’s fight to get the Continental Congress to pass an actual Declaration of Independence. As president, he championed a strong central government that was, in our terms, moderate and bipartisan.

He and Thomas Jefferson were fierce political opponents, brilliant and passionate. Their friendship grew in the years following Jefferson’s presidency. And they both died on July 4, 1826: the 50th anniversary of the release of the world’s most important press release. His last words were, “Thomas Jefferson still survives.”

Welcome to summer

Annually we have a “days of summer” issue that celebrates … well, beach weather, holidays, gardens, families, travel, and recharging. We tend to target quick, light (or “lite”) and useful. Here’s the rundown:

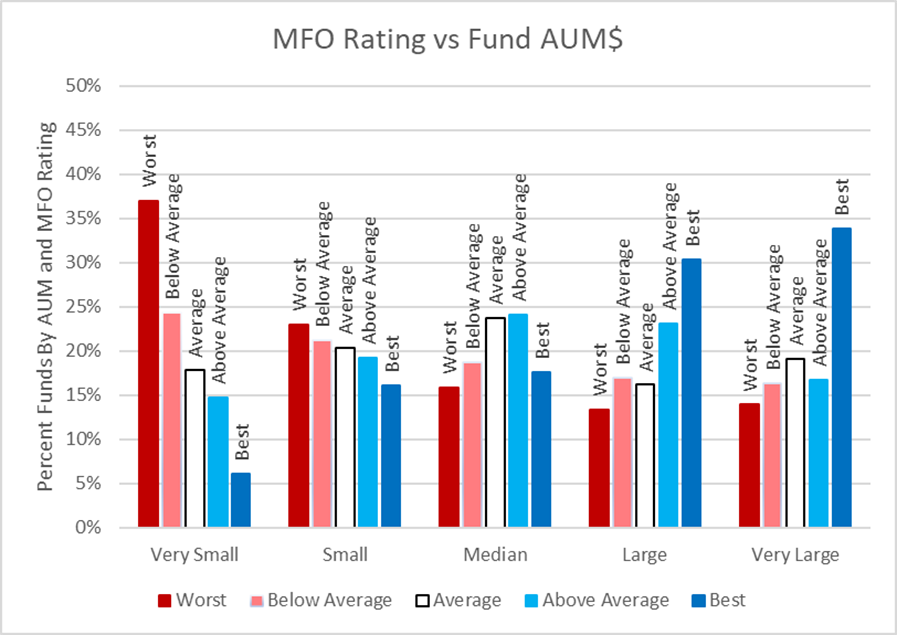

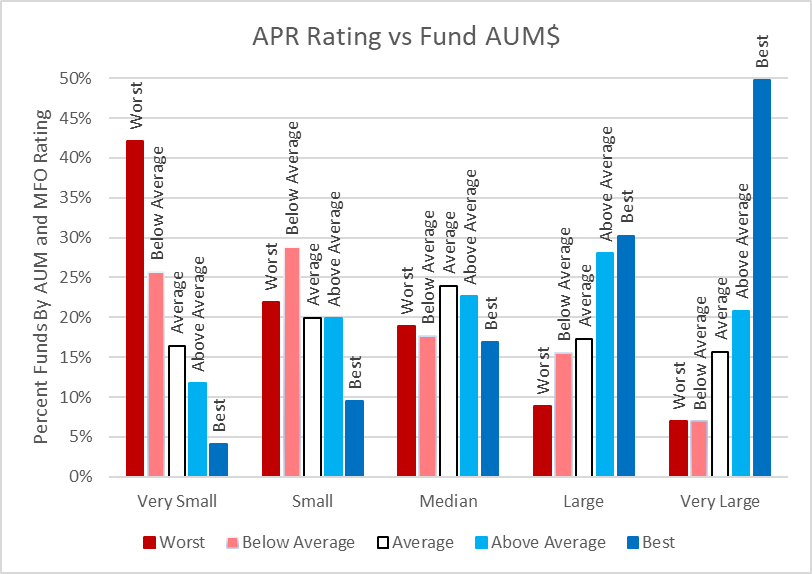

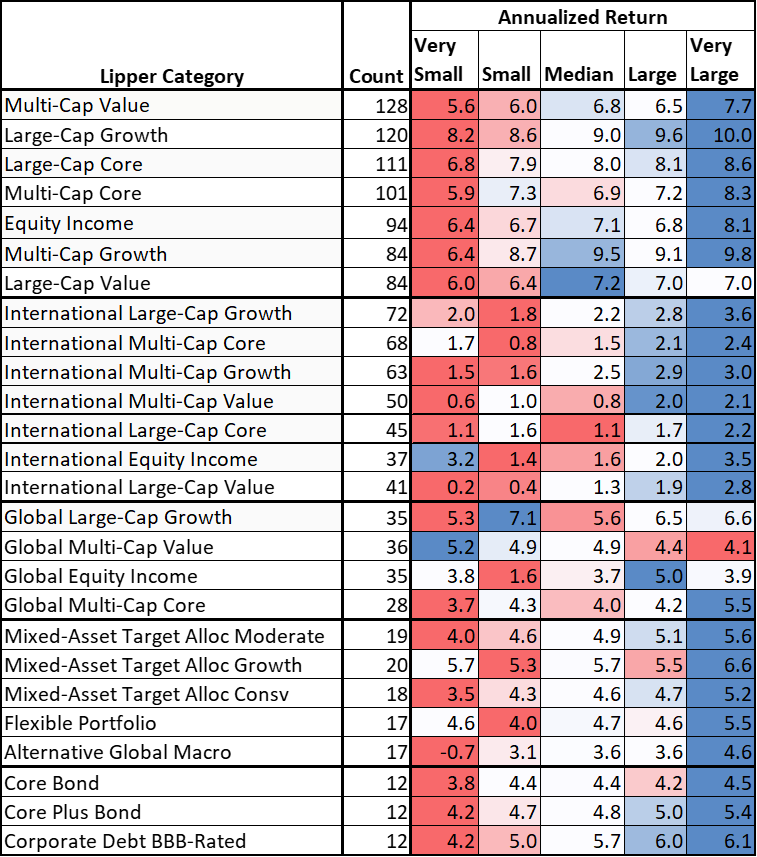

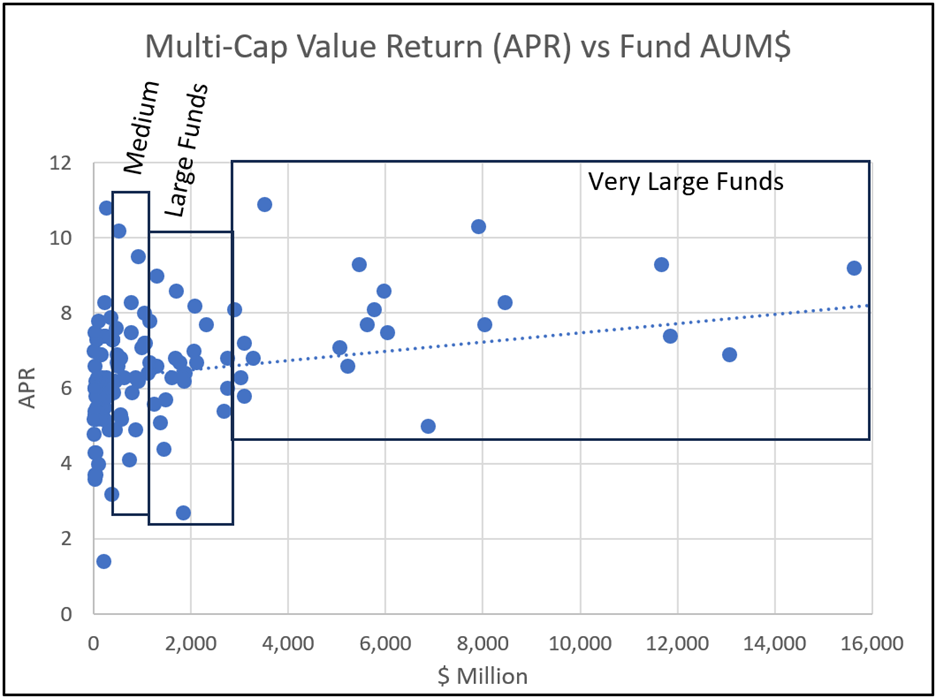

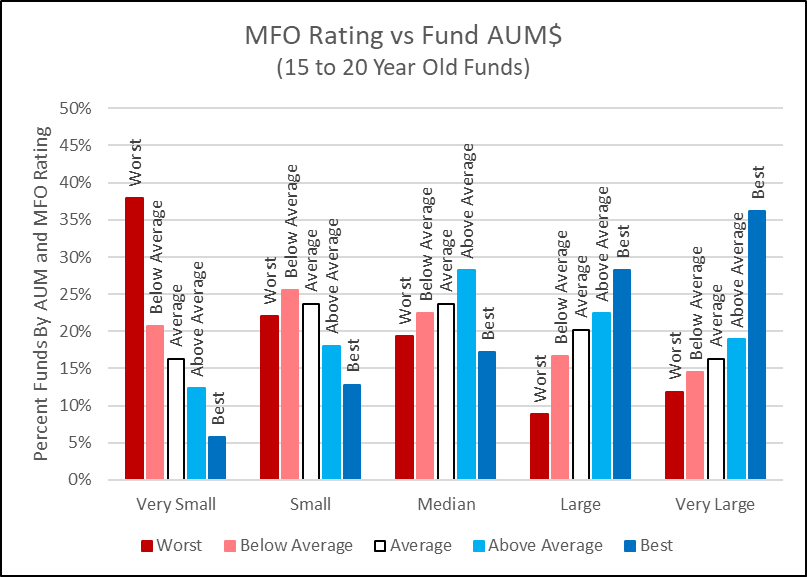

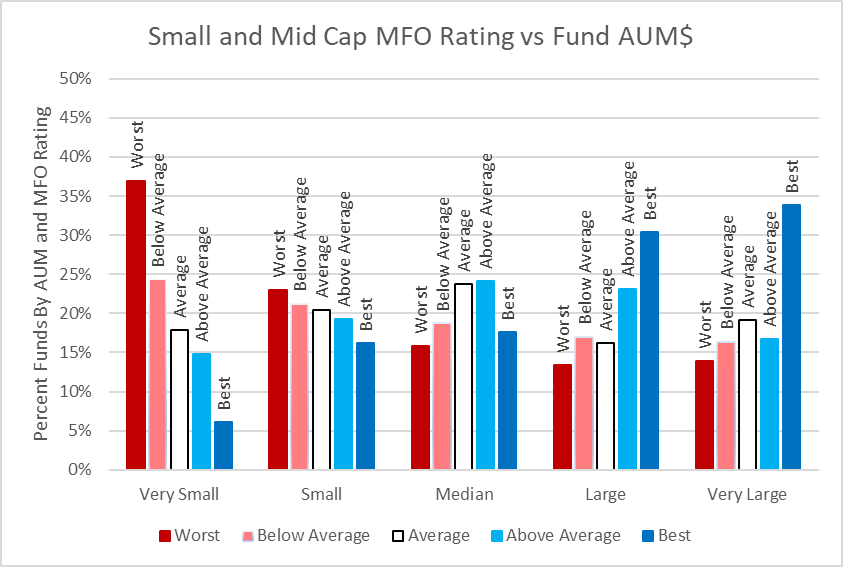

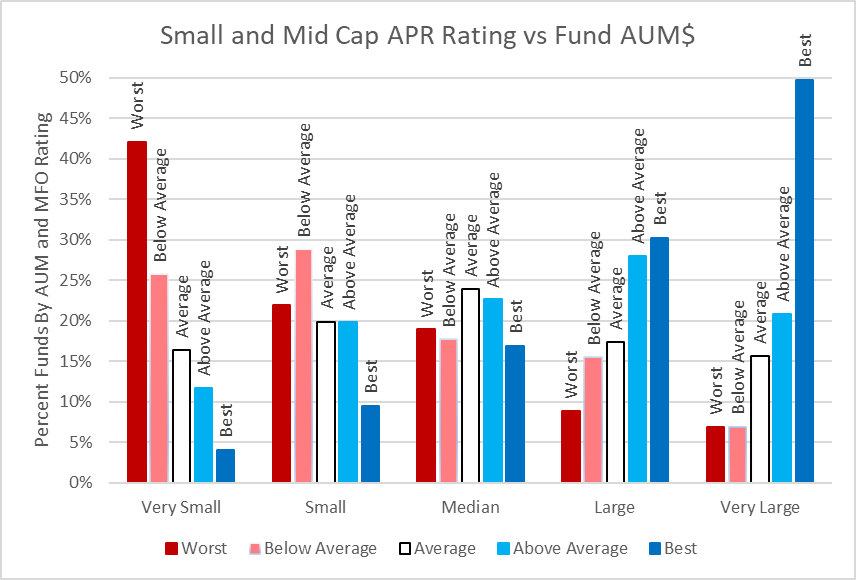

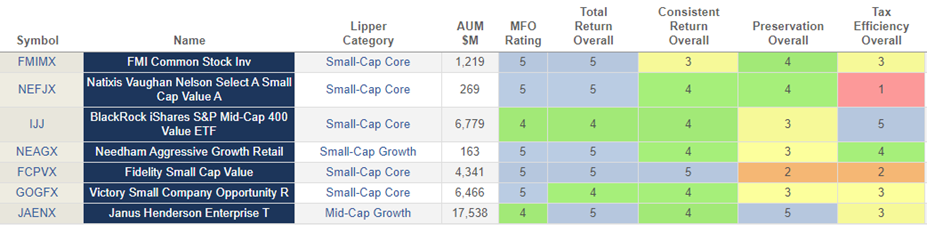

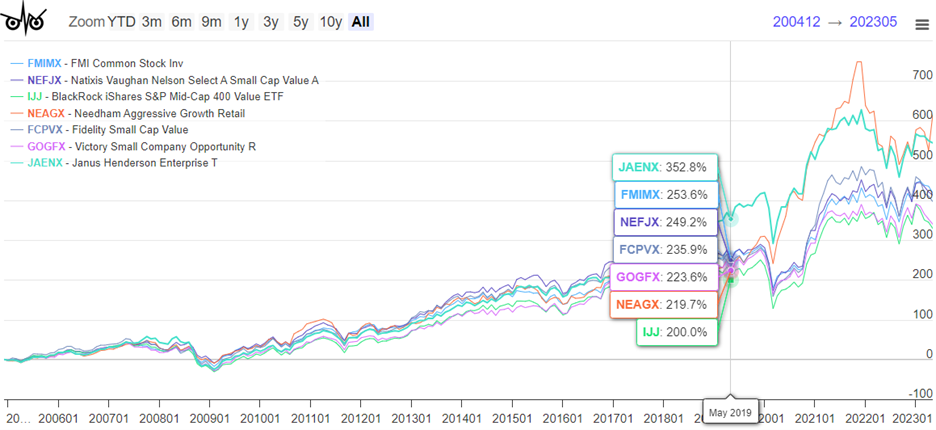

- Lynn looks at the ultimate cage match between Fidelity and Vanguard for world domination, or at least a prime position in your portfolio, and then goes on to look at whether you really should be investing in small and nimble funds. Spoiler alert: usually not, most big funds got big because they brought a systemic advantage to the table. Despite MFO’s focus on small, new and boutique, we don’t disagree with Lynn’s broad thesis. Most small funds are bad ideas, as are most big funds. The difference is that there are a lot more small funds to sort through.

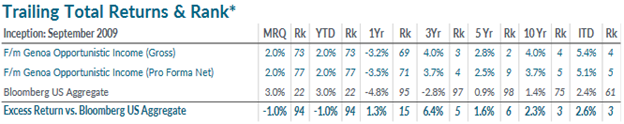

- Speaking of small funds, we’re trying a renewed “Funds in Registration” feature that focuses only on funds in the pipeline that might actually warrant your attention. This month we’re offered two and a half possibilities: Genoa Opportunistic Income ETF and Dynamic Alpha Macro Fund both of which bring really strong track records and stable teams. Genoa is working well in separate accounts and Dynamic Alpha Macro has a successful hedge fund as 50% of its portfolio. The half fund, the one just missing the case, is Polar Global Growth ETF which is the ETF version of an existing fund. The caveat is that the fund has a great long-term record and a really soft short- and medium-term one, which we’d need to understand thoroughly.

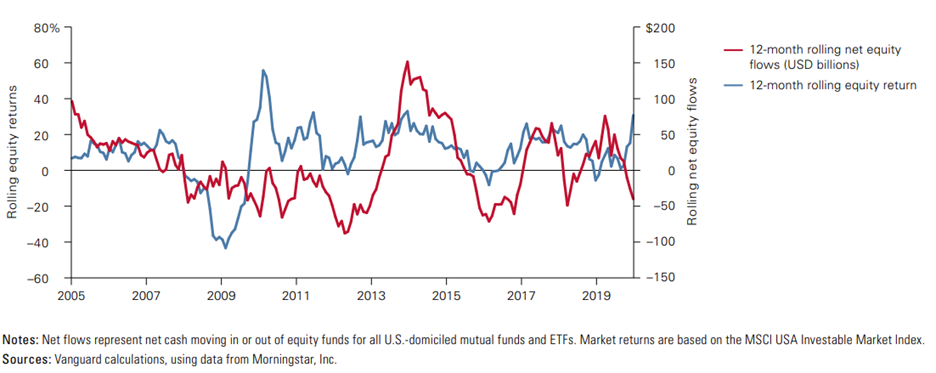

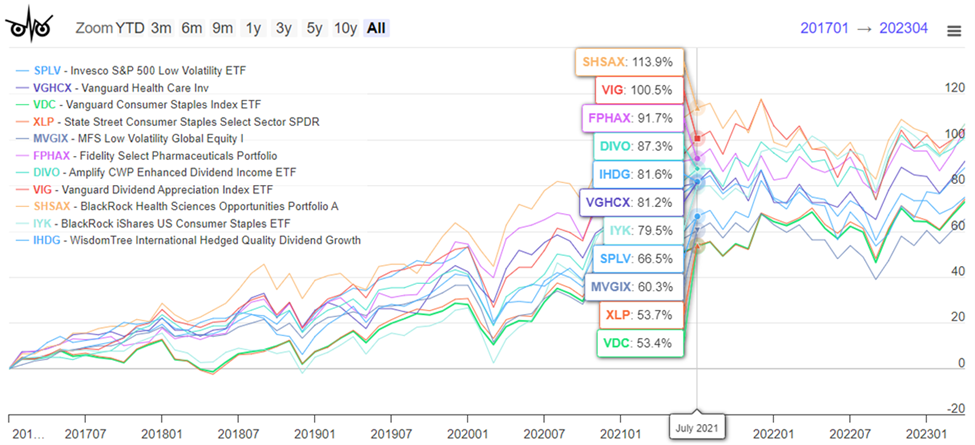

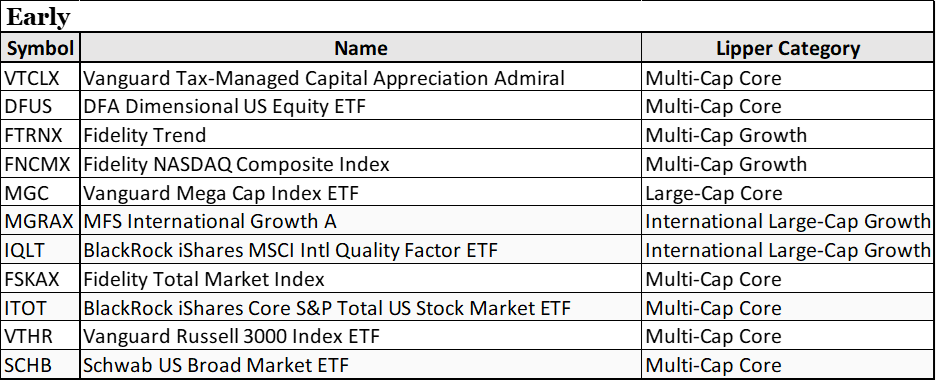

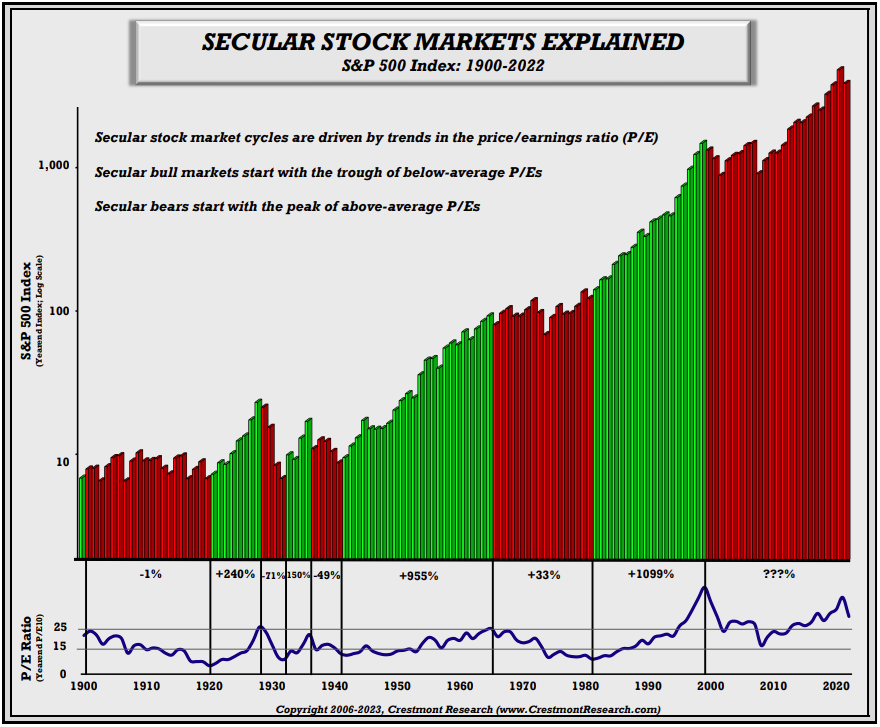

- Charles Boccadoro, the incomparable maestro of MFO Premium, cranks up the screener to test out – and tease out – the New York Times’ recent comment regarding the “longest bear market since the 1940s.” For folks who thrive on face-to-face connection, Charles will always be offering a live mid-month online discussion.

- In the military “fire and forget” refers to a weapon that can be launched but doesn’t need to be monitored after that. Investors have their own version of fire-and-forget: they often fire a manager because of a problem, and then forget to check back once the problem’s resolved.

Ten things I had been meaning to tell you

Sorry, leads pour in. In good faith, I stack them up next to the recyclables and the “healthier lifestyle” resolutions, then forget to share them with you. Here are ten things I’d been meaning to tell you.

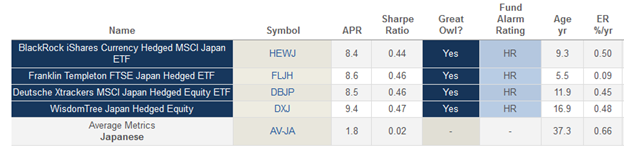

1. Warren Buffett is investing in Japan.

“Berkshire Hathaway doubles down on Japan. The conglomerate run by Warren Buffett disclosed yesterday that it has bought more shares in Japan’s five biggest trading firms and suggested that it may go further. Nikkei-listed stocks have outperformed the S&P 500 and most other large indexes this year, thanks to investor enthusiasm over Japan’s economic recovery.” (Andrew Ross Sorkin, “DealBook,” New York Times, 6/20/2023).

This aligns with David Sherman’s observation last month that Japan hosts some of the world’s best values. JP Morgan (5/2023) agrees.

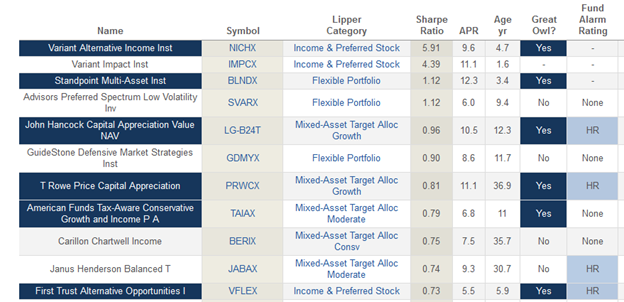

Over the past five years, the best-performing Japanese funds have two distinctions: (1) they’re ETFs, and (2) they actively hedge their currency exposure.

The “Great Owl” designation means that they’ve achieved top quintile risk-adjusted returns over all trailing periods, and the Fund Alarm Rating signals that they’ve beaten their peers for the past 1-, 3- and 5-year periods.

Morningstar’s preference as a fund for retail investors would likely be Fidelity Japan (FJPNX), which they give a “silver” rating, and which has earned four stars. Its 2.9% annual returns over the last five years handily beat its peer group while badly trailing the hedged ETFs.

2. Ray Dalio thinks that India is the next great opportunity.

Mr. Dalio is the chief of Bridgewater Associates, the world’s largest hedge fund, and is generally considered to be one of the clearest and broadest thinkers around. He regularly frets in public about one threat or another (in June alone, he discussed war with China, a fraying world order, a currency collapse, a late-cycle debt bubble, and why he’s betting big on AI) but seems singularly supportive of the prospects of India as an investment market. Speaking of Prime Minister Narendra Modi, Mr. Dalio said, “He and India are in an analogous position to Deng Xiaoping and China in the early 1980s – i.e., at the brink of the fastest growth rates and biggest transformations in the world.” (George Glover, “Billionaire Ray Dalio hails India as the next big investing opportunity,” 6/23/2023). Mr. Glover’s article quotes Mark Mobius, the most famous of the emerging markets investors, as saying, “India is the real future.”

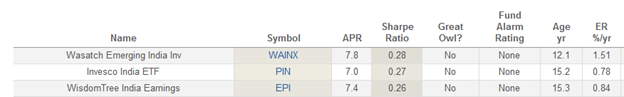

The opportunity set for small investors is less clear, in part because India, despite its huge population, has not always welcomed foreign investors. There are three pretty solid options, though.

The two passive ETFs both track indexes that attempt to incorporate measures of corporate quality. The Wasatch Emerging India Fund targets “the highest-quality growth companies in India” and has a concentrated, large-cap, high-growth portfolio.

3. Making their mark right out of the gate: the Tanking Ten

MFO’s target universe has always centered on funds that are off Morningstar’s radar. While Morningstar’s algorithms now express opinions on all funds, their analysts traditionally are working in a pool of a thousand or so of the 10,000 available.

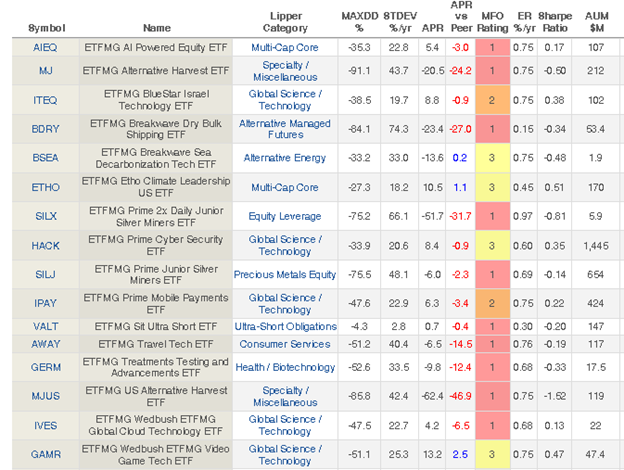

Off the radar translates to smaller, newer, distinguished but offered by boutique or specialty managers. In recognition of that, MFO Premium has preset screens for newly launched funds. Here’s a quick glimpse at the worst and the best of them.

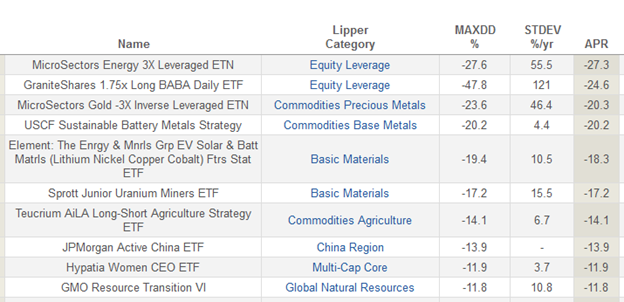

The worst-performing newbies are on pace for double-digit annualized losses, despite launching in a bull market. The easiest way to end up at the extremes of a spectrum is put big bets on narrow niches. So, for example, tripling the returns of the energy sector hasn’t been wise this year, nor at seeking 175% of the returns of Jack Ma’s Alibaba.

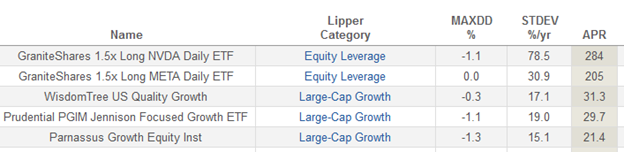

The same is true at the other extreme: big bets on this year’s winner translate to stunning returns. Two newbies are set to make over 200% a year by leveraged bets on the performance of Invidia and Meta (Facebook) stock.

We would recommend reserving those sorts of bets for a casino.

4. GMO is freakishly cheerful

Institutional investor GMO, formerly Grantham, Mayo, Van Otterloo & Co., is a very disciplined bunch. They loathe overpriced investments and overpriced markets and relentlessly hunt out pockets of exceptional value. At their peak, they managed $140 billion in assets. Today, that’s closer to $60 billion. As markets got speculative, GMO refused to play along, and investors got irked and pulled their money. GMO sort of shrugged and reminded people that they were doing precisely what they’d promised to do when you chose them as your manager.

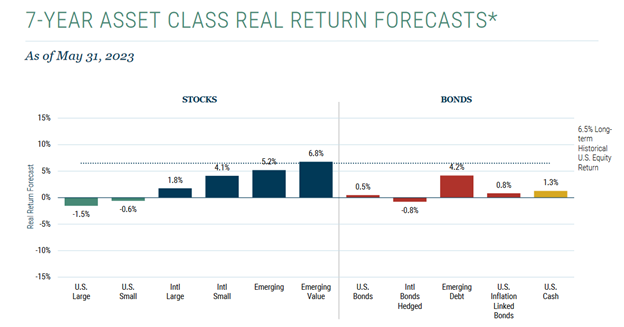

GMO monthly publishes asset class return forecasts which are driven by two simple assumptions: (1) profit margins tend to regress to their averages because high-profit niches attract competitors who steal your profits, and (2) stock valuations are, in the long term, driven by price and earnings. Based on those assumptions and lots of data, they project what a prudent investor might expect in the intermediate term.

For the past several years, before the 2022 panic, the answer was “pain and darkness.” Today, they’ve managed to reach “mostly positive returns outside the US, and pretty solid ones in international small caps and emerging markets.”

Our recommendations for people who want to explore the latter two are pretty unambiguous: Harbor International Small Cap and Seafarer Overseas Value, both of which we’ve profiled and both of which have exceptional teams.

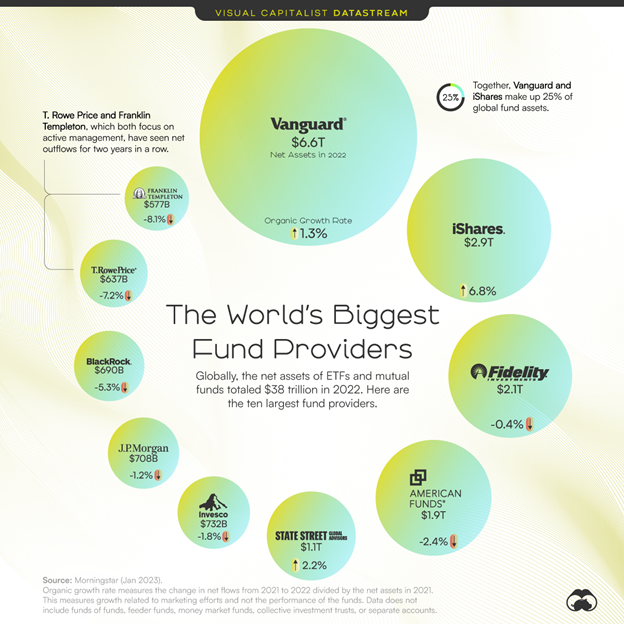

5. No, it seems like no one can beat Vanguard

Our colleague Sam Lee explained “Why Vanguard Will Take Over the World?” in a 2015 article.

Vanguard is eating everything. It is the biggest fund company in the U.S., with over $3 trillion in assets under management as of June-end, and the second biggest asset manager in the world, after BlackRock. Size hasn’t hampered Vanguard’s growth. According to Morningstar, Vanguard took in an estimated $166 billion in U.S. ETF and mutual fund assets in the year-to-date ending in August, over three times the next closest company, BlackRock/iShares. Not only do I think Vanguard will eventually overtake BlackRock, it will eventually extend its lead to become by far the most dominant asset manager in the world.

He lays out four factors that drive their move toward global dominance.

Let’s do a quick status check on Sam’s prediction, eight years later.

Source: Jenna Ross, Visual Capitalist, 6/19/2023

Just checking the math here but $6.6 appears greater than $2.9 + $2.1. That is, bigger than its top two competitors combined and inching up to being larger than its top three competitors combined since two of them are seeing declines.

Sam, for those of you who missed him, is brilliant and was a Morningstar editor at a ridiculously young age. He left Morningstar, as so many did, and launched his own firm. It was originally Severian Asset Management but transitioned to SVRN Asset Management. Founded in Chicago, he and a partner moved to Austin, Texas, where they oversee about $100 million for 18 high-net-worth clients. We archive all of our contributors’ essays, and Sam’s essays are about the best for their startling and careful insights. You should browse.

6. Doug Ramsey, Leuthold CIO, on investing in the markets ahead

Leuthold Group began life in 1981 as an institutional research firm with a singular obsession about letting data drive decisions; to make that work, they need vast amounts of data and a permanent willingness to challenge themselves and the way they’ve traditionally interpreted the numbers. They got good enough that their clients convinced them to launch an affiliated money management group, Leuthold Weeden Capital Management.

Since the retirement of founder Steve Leuthold, Doug Ramsey has held the reins as the firm’s chief investment officer and co-manager of their flagship Leuthold Core Investment Fund, which we profiled last month. In mid-June, Doug spent an hour online talking with investors have where the evidence points right now.

Highlights:

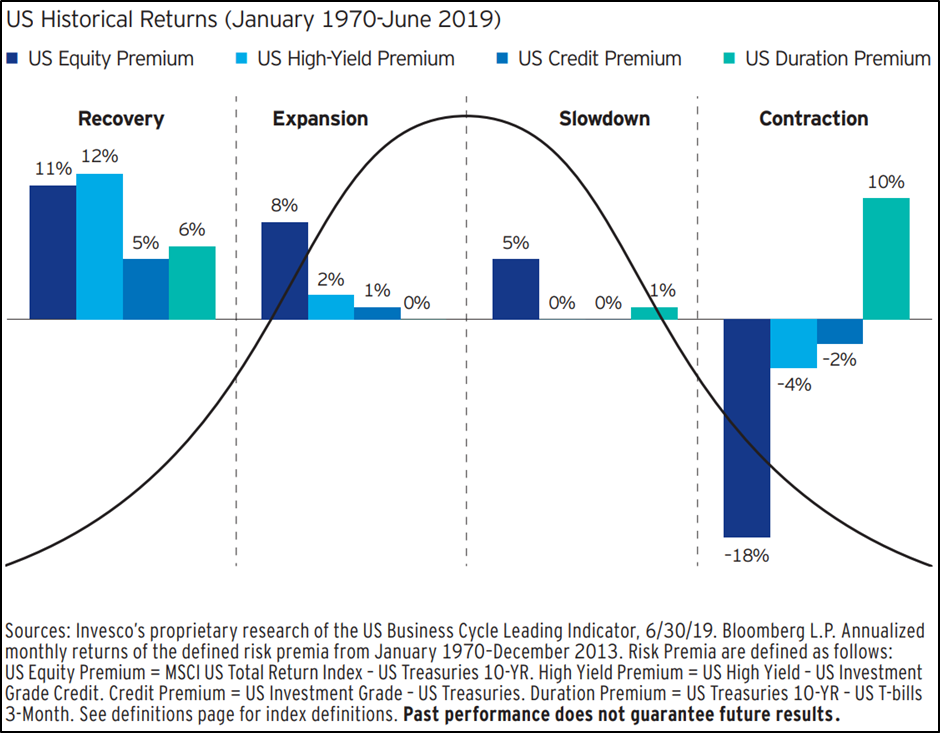

- both yield curve inversions and six-month drops in the index of Leading Economic Indicators are pointing to a business downturn beginning in fall. Both are eight-for-eight with no false positives as predictors, though their “predictions” occur with “long and variable lags.” The window for a yield curve inversion has been four to 16 months previously. Others observe that Fed actions presage recession by about two years.

- the last false signal from a yield curve inversion was in the mid-1960s. Doug talked a bit about the differences in economic conditions between then and now.

- the stock market generally rallies immediately after a curve inversion, on average by 13%, before rolling over. Currently, it’s up 16%.

- US inflation has dropped like a rock but “Fed policy has never been this tight with inflation having already come down significantly.”

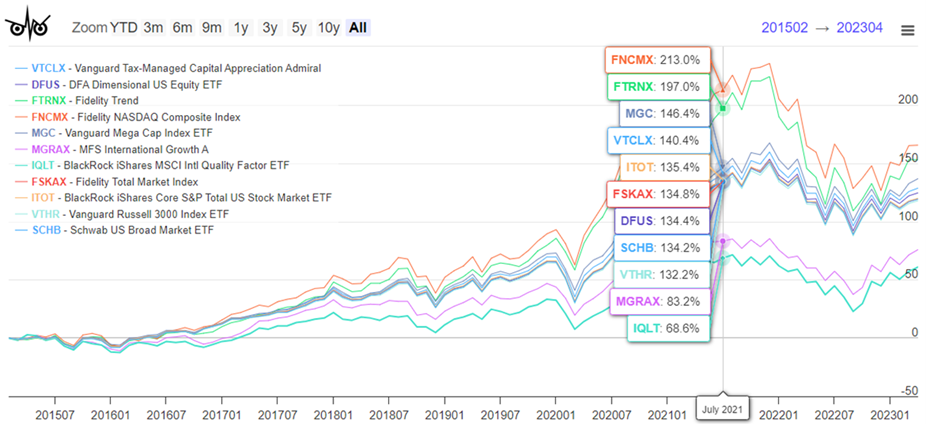

- the stock market is not in a bubble but in the top 10% of historic valuations.

- seven to nine stocks have gone crazy, driving all of the year’s returns of the S&P 500. They’re the best candidates for a smackdown.

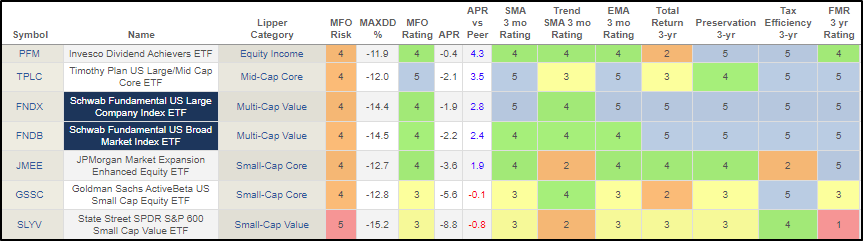

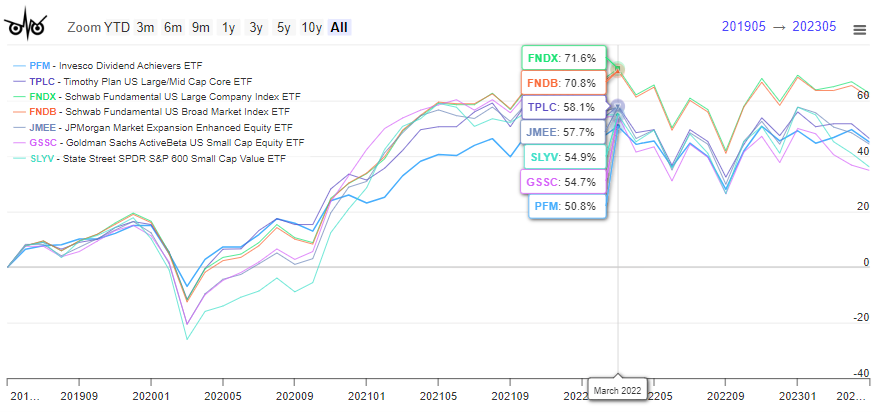

- midcap valuations are good, small cap valuations are historically good. That judgment looks only at the valuations of the 80% of small caps that operate in the black, so “small quality” might be worth your attention.

- the valuation of small caps relative to large caps is as extreme as in the late 1990s. Remember that the S&P 50 corrected by 50% in 2000-02. The S&P Equal Weight index and small caps vastly outperformed back then.

- assuming 6% earnings growth and normal valuations as the base, large caps are priced for 3.5% returns in the medium term, mid-caps are 6-7% and small caps are at 8-9%. Foreign corporate earnings still have not returned to their 2007 levels which makes such calculations for EAFE and EM, given Leuthold’s discipline, impossible.

- Leuthold Core Investment today is 51% net equities with no evidence that they’re going to drop toward their 30% minimum allocation; their investable universe looks like the S&P 1500 Equal Weight and that’s not looking nearly as risky as it did 18 months ago.

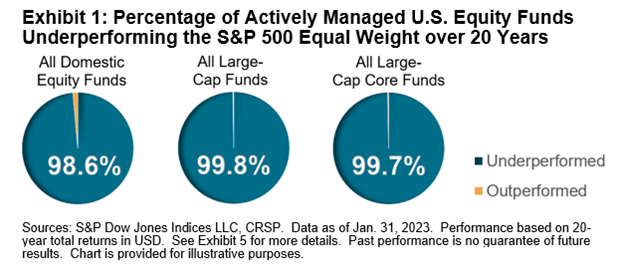

7. S&P 500 Equal Weight Indexes are intriguing

The performance of the S&P 500 Index is, and always had been, driven by the fate of a handful of megacap stocks. Year-to-date in 2023, the index is up 16.9% (through 6/30/2023). The median stock in the index, Merck, is up just 4% and more than 200 of its stocks are in the red. The level of concentration in the S&P 500 portfolio is higher now than it was at the peak of the late 1990s bubble. The index’s fundamental imperative is this: buy more of whatever has been doing well. Inevitably, structurally, growth and momentum drive the portfolio. Fame and low-cost access add to its appeal.

That said, there are long periods when “smaller and cheaper” offer more compelling possibilities. A host of professional investors, from Cohanzick’s David Sherman to Leuthold’s Doug Ramsey to Morningstar’s John Rekenthaler suggest that you might want to accelerate your due diligence on an equal-weight index. There are three reasons for this.

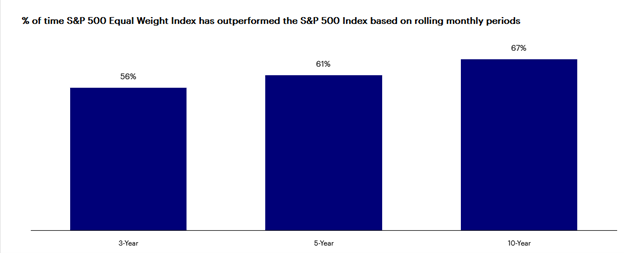

First, over periods of more than one year, the Equal Weight Index tends to outperform its more famous market-weight sibling.

Second, the equal weight index beats almost all actively managed funds over the long term.

Source: S&P, “More Equal than Others: 20 Years of the S&P 500 Equal Weight Index” (6/2023)

Third, the equal weight index buys low. It operates on the opposite dynamic of the S&P 500: it buys more shares of cheaper stocks and fewer shares of expensive ones. That is then reflected in a substantial discount in the portfolio.

Forward p/e: 15.3 for Equal Weight, 18.7 for Market Weight

Price/book ratio: 2.84 versus 3.81

Price/sales ratio: 1.53 versus 2.19

Price/cash flow ratio: 23.1 versus 26.8

If you are an advocate of low-cost passive investing but anxious about the domination of your portfolio by just five or six or seven stocks, there are several equal-weigh index funds to consider. The Big Dog is the Invesco S&P 500 Equal Weight ETF (RSP) which has seen $5 billion in net inflows in the past month. We would recommend a serious look at ONEFUND S&P 500 Equal Weight Index (ticker: INDEX, which is cute) which has minutely outperformed the ETF and its underlying index since inception. The key comes down to a superior trading strategy that takes advantage of price inefficiencies in the opening minutes of each day’s market.

8. It might be time to renew the ETF Deathwatch

I was always slightly irked by the early champions of ETFs who regularly rejoiced at the imminent demise of the mutual fund dinosaurs. Two things struck me: (1) mutual fund companies were huge, well-resourced, and predatory. If they found the ETF niche interesting, they’d simply eat it and everyone in it. And they have: Moreover (2) investing is not an infinitely expanding universe. Treating it like it is – by launching dozens of speculative ETFs (the KPOP and Korean Entertainment ETF?) in the desperate belief that someone will get excited – was a recipe for failure. And, indeed, it is: 583 ETFs are at high risk of closure, a substantial fraction of the 3000 fund universe. The number of ETF closures are now approaching the number of launches. (Heather Bell, Dark Days May Be Looming for ETFs, 3/28/2023)

9. Harry Markowitz, in memoriam

Harry Markowitz (August 24, 1927 – June 22, 2023) died in a San Diego hospital at the age of 95. He was the most influential guy you never heard of. Dr. Markowitz received the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences with Merton H. Miller and William F. Sharpe. In 1999, Pensions & Investments named him “man of the century.”

He was an interesting soul. His work laid the foundation for much of the modern finance industry. And yet he, himself, was not a finance guy and not particularly interested in the subject. He started out writing algorithms and running simulations. Financial markets were merely a rich source of interesting data with which to test the models. Harry started his critique of traditional finance practice by thinking about the behavior of bettors in a casino. “I’ll put it all on red 27” is a recipe for misery, so bettors spread their bets, trying to tilt the odds in their favor. Sometimes that pays off, sometimes it doesn’t. It’s hard to imagine, but until Markowitz, the received wisdom in investing was “find the market’s top couple stocks and put every penny there.” Markowitz knew that made no sense, and had the data to prove it. In being dubbed “the father of Modern Portfolio Theory,” we’re actually saying “the guy who proved the benefits of diversification.”

In 1968 Dr. Markowitz began to manage a successful hedge fund, Arbitrage Management Company, based on M.P.T., that is believed to have been the first to engage in computerized arbitrage trading. But he wasn’t wedded to it and I get the sense he didn’t stick around all that terribly long.

10. Thanks, as ever …

To Chip, for toiling away to publish this issue even when she’s on vacation with family (and especially since she’d rather be writing really tight data security protocols and reading trashy novels).

To Devesh, Lynn, and The Shadow for working so hard each month to help make others’ lives a bit more sane.

To Raychelle and Aahan, who you haven’t yet met but who are toiling under the hood to keep everything clear and current.

To the Weeks Family Charitable Fund, operating through a Fidelity Donor-Advised Fund, for a generous gift and kind thoughts.

To our faithful subscribers, Greg, William and the other William, Brian, David, Wilson, Doug, and the good folks at S&F Investments.

And to all of you who read our work: Takk! Tapadh leat gu mòrk! Grazie mille!

Which is a reminder that Chip and I will be vacationing in the Scottish Highlands when our August issue launches, with part of our time spent in Shetland – halfway between Scotland and Norway. We’ll send pictures!

As ever,

GoodHaven Fund (GOODX) was launched in April 2011 by Larry Pitkowsky and Keith Trauner, two former associates of the iconoclastic Bruce Berkowitz, who manages Fairholme Fund. During their time at Fairholme, the guys rose from research analysts to portfolio managers, CIOs, and vice presidents. In 2010 they left Fairholme and about 12 months later launched their own fund. The fund had two good years, then a long stretch of lean ones. The managers lamented “frustratingly modest gains” in their 2017 Annual Report. In each of 2013, 2014, 2015, and 2017, they trailed more than 97% of their peers.

GoodHaven Fund (GOODX) was launched in April 2011 by Larry Pitkowsky and Keith Trauner, two former associates of the iconoclastic Bruce Berkowitz, who manages Fairholme Fund. During their time at Fairholme, the guys rose from research analysts to portfolio managers, CIOs, and vice presidents. In 2010 they left Fairholme and about 12 months later launched their own fund. The fund had two good years, then a long stretch of lean ones. The managers lamented “frustratingly modest gains” in their 2017 Annual Report. In each of 2013, 2014, 2015, and 2017, they trailed more than 97% of their peers.